Moving average convergence – Divergence are well-known indicator in finance for determining whether prices are rising or falling. People like to use it to check if anything, such as a stock or cryptocurrency, is gaining or losing value. It’s like having a specific compass for money that guides your steps through the financial world.

Convergence:

Convergence is the process by which the price of a futures contract, for example, starts to move closer to the price of the actual good you will receive (such as a tangible object or cash) as delivery time approaches. As the delivery date approaches, it appears as though the two prices are merging.

Divergence:

When the MACD Line and the price of the securities move in opposing directions, there is a divergence. Divergence that is bullish can indicate a potential upward turn, while divergence that is bearish can indicate a potential downward turn.

The MACD is calculated using the following steps:

a. Calculate the 12-period Exponential Moving Average (EMA) of a security’s closing prices.

EMA = (K x (C – P)) + P

Where:

C = Current Price, say $24.23

P = Previous periods EMA, say $23.92

K = the Exponential smoothing constant. Recall that K= 2÷(N+1)

The smoothing constant K, applies appropriate weight to the most recent price. It uses the number of periods specified in the moving average.

Solving for K first

K = 2÷(N+1)

= 2÷(12+1)

K = 2÷13

K = 0.1538 (4 d.p.)

EMA = (0.1538 x ($24.23 – $23.92)) + $23.92

= (0.1538 x $0.31) + $23.92

EMA = $0.0477 + $23.92

= $23.9677

EMA = $23.97 (2 d.p.)

b. Calculate the 26-period EMA of the same closing prices.

EMA = (K x (C – P)) + P

Where:

C = Current Price, assuming it to be $24.23

P = Previous periods EMA, say $23.92

K = the Exponential smoothing constant. Recall that K= 2÷(N+1)

Solving for K

K = 2÷(26 + 1)

= 2÷27

K = 0.0741

EMA = (0.0741 x ($24.23 – $23.92)) + $23.92

(0.0741 x $0.31) + $23.92

$0.023 + $23.92

$23.943

EMA = $23.94 (2 d.p.)

The smoothing constant K, applies appropriate weight to the most recent price. It uses the number of periods specified in the moving average.

c. Subtract the 26-period EMA from the 12-period EMA to get the MACD Line.

26-Period EMA = $23.94

12-Period EMA = $23.97

Subtracting: $23.97 – $23.94 = $0.03

.

d. Calculate a 9-period EMA of the MACD Line to create the Signal Line

EMA = (K x (C – P)) + P

Where:

C = Current Price, say $24.23

P = Previous periods EMA, say $23.92

K = the Exponential smoothing constant. Recall that K= 2÷(N+1)

The smoothing constant K, applies appropriate weight to the most recent price. It uses the number of periods specified in the moving average.

Solving for K

K = 2÷ (9+1)

= 2÷10

K = 0.2

EMA = (0.2 x ($24.23 – $23.92)) + $23.92

= (0.2 x $0.31) + $23.92

= $0.062 + $23.92

EMA = $23.98

e. Optionally, calculate the MACD histogram, which is the difference between the MACD line and the signal line.

MACD Line: Represents the short-term momentum and the difference between the 12-period and 26-period EMAs.

Signal Line: A 9-period EMA of the MACD Line that smooths out the MACD Line.

The MACD histogram: A graphic representation of the divergence and convergence of the MACD Line and the Signal Line.

EMA of 9-period single line of MACD = ((CP – P9p) x K + P9p)

(($24.23 – $23.98) x 0.2 + $23.98)

($0.25 x 0.2 + $23.98)

($0.05 + $23.98)

= $24.03

Where

CP = ClosePrice Current Bar

P9p = previous 9-period EMA of MACD

K = Smoothing constant, i.e. 2÷(N+1)

MACD Line = $0.03

Signal line: $24.03

Difference = $0.03 – $24.03 = $-24

Interpretation:

Signal line compared. the MACD line:

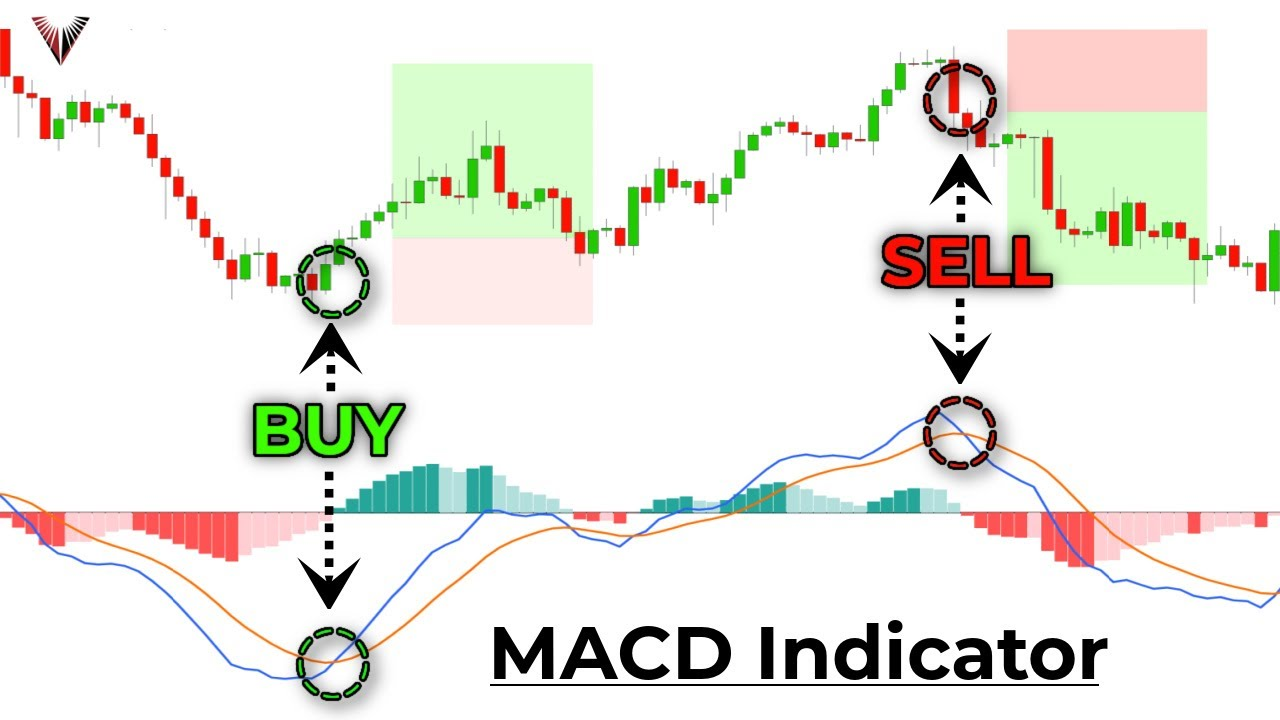

A potential buy signal is created when the MACD Line crosses over the Signal Line.

A potential sell signal is created when the MACD Line descends below the Signal Line.

Histogram:

Bullish momentum is indicated by positive histogram values (MACD Line above Signal Line).

The strength of the trend is shown by the height of the histogram bars

Uses:

Trend identification: MACD aids traders in determining a trend’s strength and direction.

Signal generation: Buy and sell signals are produced by crossing over the MACD Line and the Signal line.

Divergence: A divergence between the MACD and price may indicate that a trend is about to change.

Trading professionals use the histogram to detect changes in momentum.

Timeframe: Depending on the objectives of the trader or investor, the MACD can be applied to a range of periods, including intraday charts and charts with a longer time horizon.

Strengths:

Simple to understand and use.

Can be effective in trending markets.

Provides clear buy and sell signals when used with other indicators.

Limitations:

In unstable or sideways markets, it could produce invalid indications.

Slow indicator: It might not offer immediate notifications for quickly changing markets.

Relies on previous pricing data and cannot take all market dynamics into consideration.

MACD Variations: To fit their own trading styles and choices, traders and analysts frequently alter the MACD settings (such as the EMAs or timeframes) that are used.

Like this:

Like Loading...

Related

0 Comments